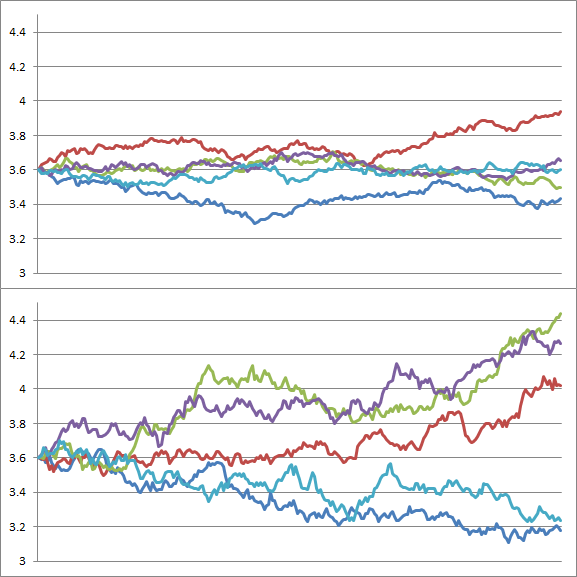

Frontiers | Evaluating Credit Counterparty Risk of American Options via Monte Carlo Methods: A Comparison of Tilley Bundling and Longstaff-Schwartz LSM

SciELO - Brasil - Valuation of american interest rate options by the least-squares Monte Carlo method Valuation of american interest rate options by the least-squares Monte Carlo method

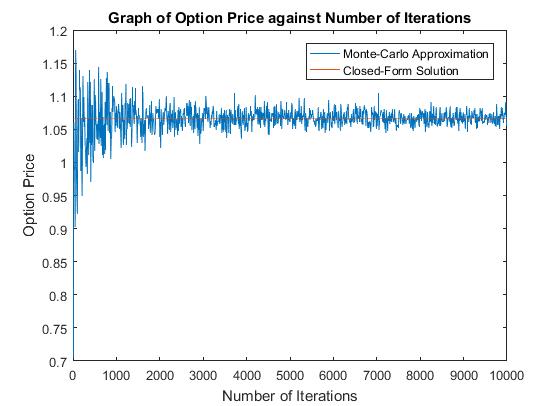

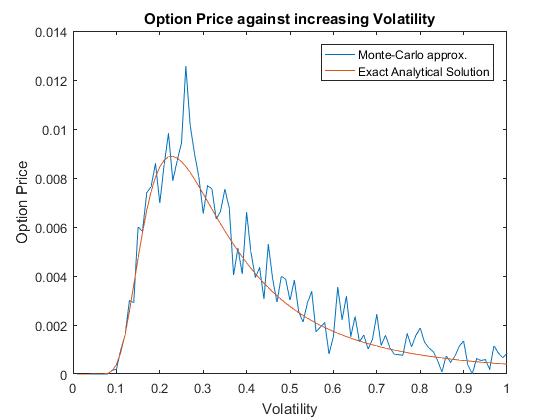

Valuing American Options Using Monte Carlo Simulation –Derivative Pricing in Python - Harbourfront Technologies

PDF) Monte Carlo Simulation for American Option Pricing | Yizhou Chen, Yiwei Zhang, and Jason Massey - Academia.edu